The Order Flow Trading Ecosystem

Getting clear on what order flow trading is, and what tools are required to become an order flow trader.

When I first started my venture into order flow trading, the information I found online was so damn scarce and unstructured.

The term “order flow” seemed to be a vague label that every part-time trading influencer would slap on to their discretionary trading style just to sound smart.

With this article (and it’s subsequent postings), I aim to provide clarity, structure, and a modern guide to order flow trading and how to get started with it.

No ambiguity, no BS, just straight to the point with practical information.

This post will start with the “order flow ecosystem” - your essential toolbox as an order flow trader, and how each tool is used.

Let’s get into it.

Earn funding and trade futures with Topstep (20% discount link)

Getting Clear on What Order Flow Trading Is:

Let’s first clear the air on what order flow trading/analysis is in a very simple manner first.

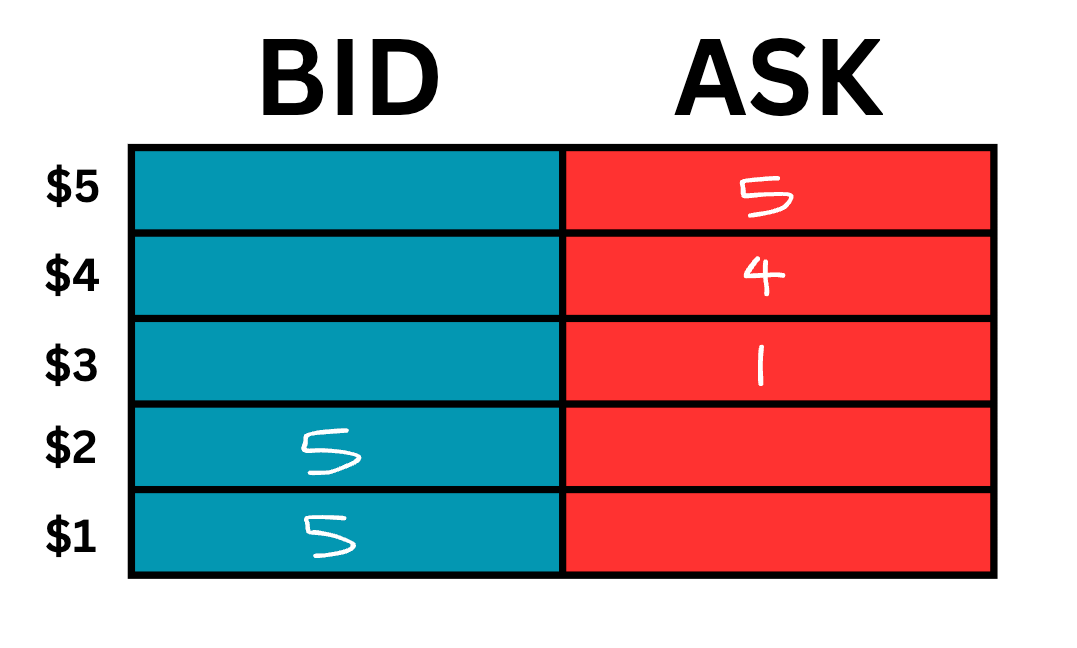

The market is made up of passive orders, AKA liquidity:

These numbers in the two columns above are passive limit orders with intent.

The numbers in the blue column represent individual contracts that are willing to buy at the respective price.

The numbers in the red column represent individual contracts that are willing to sell at the respective price.

Price can only move when a “market execution” consumes the passive liquidity.

A market execution is when a trader chooses to cross the spread and buy the ask, or sell the bid.

Market orders can only execute at the best bid (for sells), or best ask (for buys).

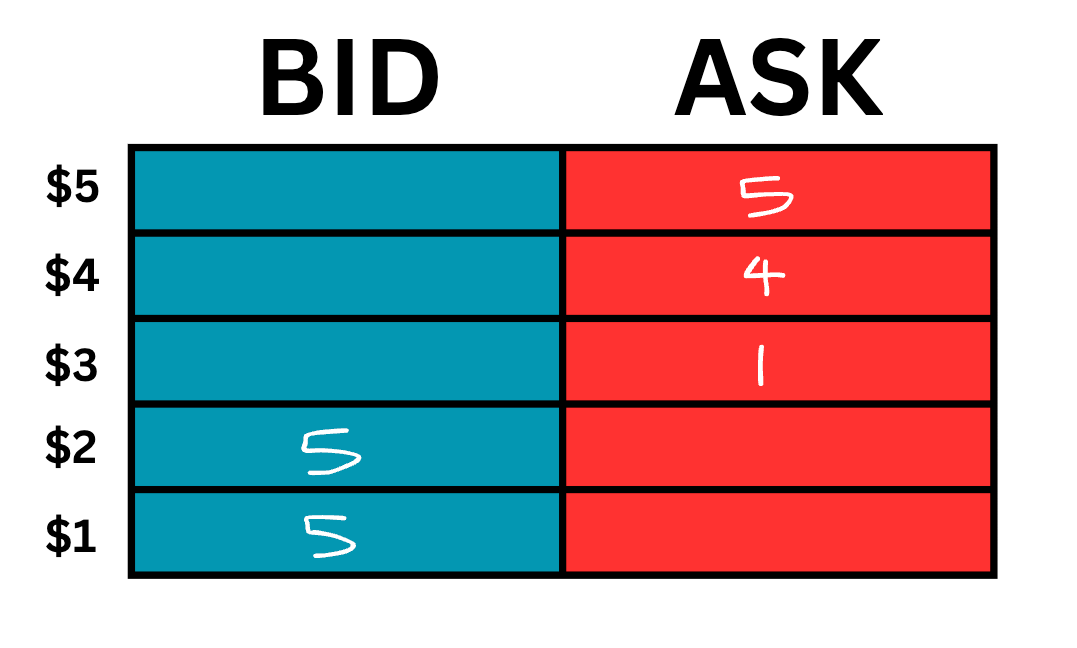

In this example, let’s say a market execution buy order hits the market.

A market participant executes a buy of one contract, consuming the passive order at $3:

Because there is now no more sell liquidity at the $3 level, having been consumed by the market buy order - price ticks up.

When there are no more passive sell orders to consume at this level, successive market buy orders will “eat” into higher ask limit orders and price will continue to tick up, and vice versa.

This is unequivocally how the market moves up and down.

All order flow analysis is is a variation on this theme across different toolsets and time horizons.

So How Do We Use This to Make Money in the Markets?

Using order flow analysis, we are trying to figure out:

“Right here, right now, what is the market ACTUALLY doing?”

We’re not predicting the future, and we certainly don’t rely on guess work, candle patterns, fibonacci levels - order flow trading is based on facts and the present moment.

Remember that order flow itself is not a trading strategy alone; rather it is a way of viewing the market, a perspective, a toolset.

We use order flow tools to inform our trades, and build up our own discretionary strategy based on information we glean from these tools.

This is Your Order Flow Toolbox:

Below are the tools we use to analyse and trade order flow.

By “higher level analysis”, I mean anything up to the daily timeframe. By “short term analysis”, I mean everything down to the very pulse of the market:

Higher Level Analysis:

Cumulative Delta

Volume

Footprints

Short Term Analysis:

Volume

Footprints

Depth of Market (DOM)

Time & Sales

In next weeks issue, we will start by breaking down the Short Term Analysis tools, how to read them, and practical trading setups using these tools.

I have a feeling most of you reading this are moreso interested in short term trading/scalping (as am I, lol) rather than the higher timeframe stuff, so I won’t waste any time in getting to the nitty gritty.

Note: I personally use TradingView’s footprint charts and cumulative delta, and TopstepX for everything else.

I will be releasing a video on YouTube tomorrow about how to setup each platform respectively.

I hope you found this first instalment helpful. If you did, please share this article with anyone you think might be interested in order flow.

Catch you next week!

~Cammy Capital

Discount Links: